OTT has become, in just ten years, the sinews of war for all media companies. These services are increasingly being adopted globally, but with disparate growth region by region.

For example, in Europe, why Scandinavian countries have almost 80% market penetration rate (for 18-50 year olds) while France only have 25%?

The market is also very heterogeneous in terms of the content offering and major players. Why some services are global when others regional or local? Why does Netflix in the US offer more than 6000 programs, and only 2000 on its catalogue available in France?

Three factors can influence the development of OTT at the global level : cultural, legal and technological.

Let’s look for all the different continents these 3 points in order to better understand the sector as a whole.

1 – THE NORTH AMERICAN MARKET

The North American market is the largest in the world. For example, Netflix has nearly half of its customers in this area. But the region is already mature and is expected to make limited progress in the coming years.

Cultural

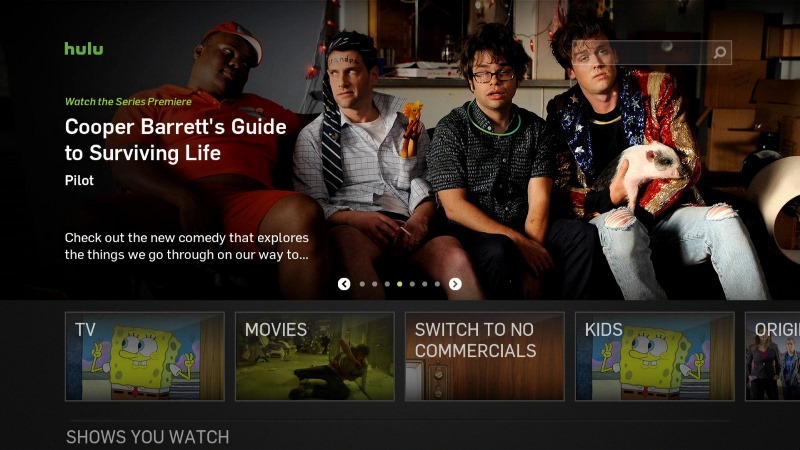

This region is the cradle of OTT and its largest market. North Americans saw the birth of Netflix in 1997, which, before revolutionizing the industry in 2007 with its video-on-demand service, was renting VHS and DVDs. The North American market then saw the arrival of Hulu and Amazon Video to compete with Netflix in the SVOD sector.

It should be noted that the catalogue of the various services is made up of American films in great majority, so for Americans considered as local films.

Americans have always been used to pay for TV services: cable television is a pay service in the United States for many years, and people has a budget for that. This makes it much easier for these companies to impose their services. For example, more than 1/4 of Americans spend more than $15 a month on OTT services.

Legal

Land of ultra-liberalism, the United States has almost no rules regarding distribution, and Canada is in a similar situation. Thus, almost all films can be offered on any platforms offering a very large catalogue for the consumer with more than 6000 contents on Netflix for example.

Technological

The area is the best equipped in the world, with the vast majority of the population having an excellent Internet connection and modern devices, making it easier for OTT companies to launch and grow in the area.

Main actors

Netflix (50%)

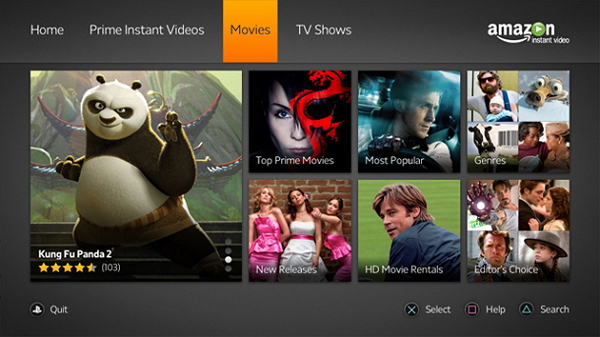

Amazon Video (Amazon Prime) 20%

Hulu (SVOD) 15%

MLB.TV

HBO Now

Starz

YouTube Red

Showtime

CBS All Access

Sling TV

2- WESTERN EUROPE

Cultural

OTT market is is divided into two parts in Europe, the first part has directly adopted it, the second one is still struggling to establish itself: on the one hand the Anglo-Saxons and Scandinavians, and on the other hand the Latin countries.

Several points to explain this gap:

- Catalogue: local cinema is very important in Latin countries. However, this cinema is rarely present in the catalogues of American giants. On the other hand, English cinema is present on these platforms.

- Language: culturally speaking, Latin countries are less accustomed to English (all television content is dubbed) than Scandinavian and of course Anglo-Saxon countries. This difference makes it less difficult for global platforms to establish themselves in the northern zone (because they do not have to localize contents in the original language) than in Latin countries.

Legal

This point is more technical but very symptomatic of cultural differences. Although there isn’t European legal harmony at the moment, there are many cultural exceptions in the countries. Major U. S. platforms are not based in the countries in which they broadcast and are therefore not subject to the laws. In France, for example, they are exempt from the creation and investment obligations to which local players are subject. States are trying to regulate more and more, in particular by forcing these platforms to comply with certain production requirements.

In addition, the OTT platforms will be obliged to have a certain quota of European works in their catalogue, thus obliging them to invest in local cinema.

In France, there is, in addition, an even harder law for any VOD or OTT service: the media chronology, which penalizes them by imposing on films a special delay after their release in theatres. The catalogue is therefore less attractive, as it is often seen elsewhere in Latin countries.

Technological

In the same vein as North America, Europe is well equipped, so this factor is not really an obstacle for any market development.

Main actors

- Netflix

- Amazon Prime

- My Canal

- Sky Go

- Mediaset

- Molotov.tv

- e-cinema

- MaxDome

- Watchever

- VodaphoneTV

- WatchNow

- PickleTV

3- ASIA PACIFIC

Asia, which accounts for 13% of the world’s OTT shares, is clearly rising and is expected to reach 22% by 2022, making it the second largest market. This market is therefore an important basis for the strategy of these companies. But the market is very fragmented and changes radically from one country to another, whether in terms of government policy or living standards.

Cultural

Like Europe, Asia has a very strong local cinema. This region still manages to resist the American hegemony, whether in South Korea, India, Japan or even Hong Kong, local cinema remains very important.

In addition to this, the “cultural gap” between the United States and these countries makes very difficult for these OTT platforms to make a place for themselves.

Moreover, in these countries film piracy is very important, which makes the implementation of these platforms more complicated. Also, incomes are highly variable, sometimes low, and do not encourage people to invest in entertainment services.

Legal

Asia has always been a complicated market for political reasons. For example: Netflix is not in China, mostly because there don’t want someone control and change their editorial offer.

In Korea, with its film OKJA, Netflix is in trouble. By deciding to broadcast it simultaneously in cinema and on the platform, the California giant was boycotted and his film, never shown in theatres.

Technological

Asia is divided into two parts: in China, Japan and Korea the rate of equipment for populations is at the same level or even higher than in Europe.

But in Southeast Asia, the rate is rather low, even if the number of smartphones is exploding. The challenge for OTT companies in this area is to adapt to these devices and specific consumption patterns.

Main actors

- Netflix

- Iqyi

- Tencent Video

- Youku

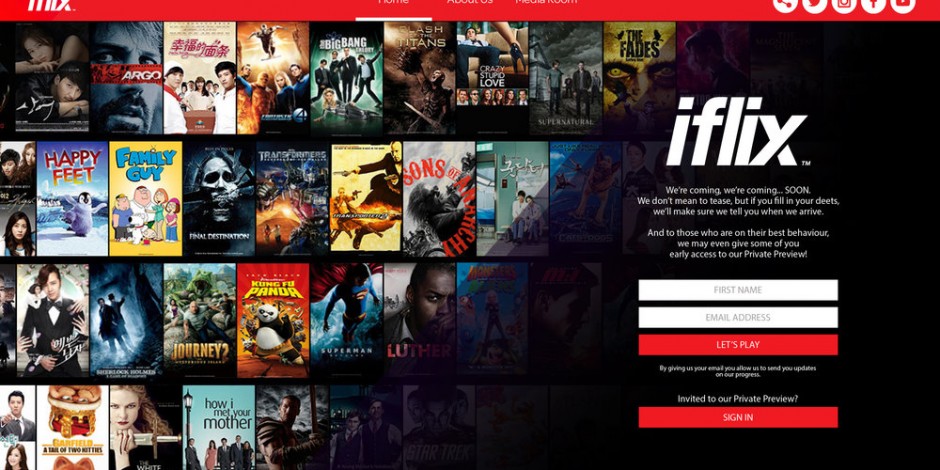

- Iflix (4 million users)

- Viu

- Tonton (6.5 million users)

- HOOQ

4- AFRICA

Cultural

Like the Asian market, Africa attracts. After having missed out on digital terrestrial television (DTT), the territory seems to be ready not to miss the big OTT opportunity.

However, one problem remains: income. The continent remains poor and the OTT subscriptions cost of may be an obstacle.

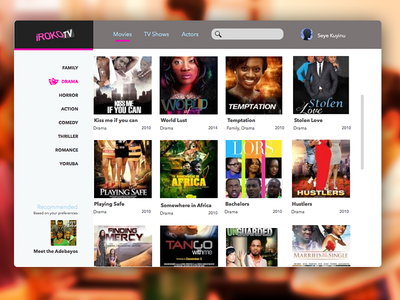

For the moment this market is being driven by local players like iROKO but Netflix is catching up.

Legal

There are few regulations on the market for the time being, allowing companies to have freedom of content.

Technological

Probably the most complex area. There is low installation and equipment rates, making market penetration very difficult.

In Africa, as in Asia, the majority of the population uses mobile devices and therefore it is necessary to adapt its service to these specificities. Some players are aware of this, such as Ericsson, which has chosen to market its platform only on mobile phones.

Main actors

Netflix

IROKO

Showmax

DStv

BoxOffice

OTT is conquering the world, don’t miss the train, create your video platform today with OKAST in just a few clicks.